Fellow Portrait

Rania Gaafar

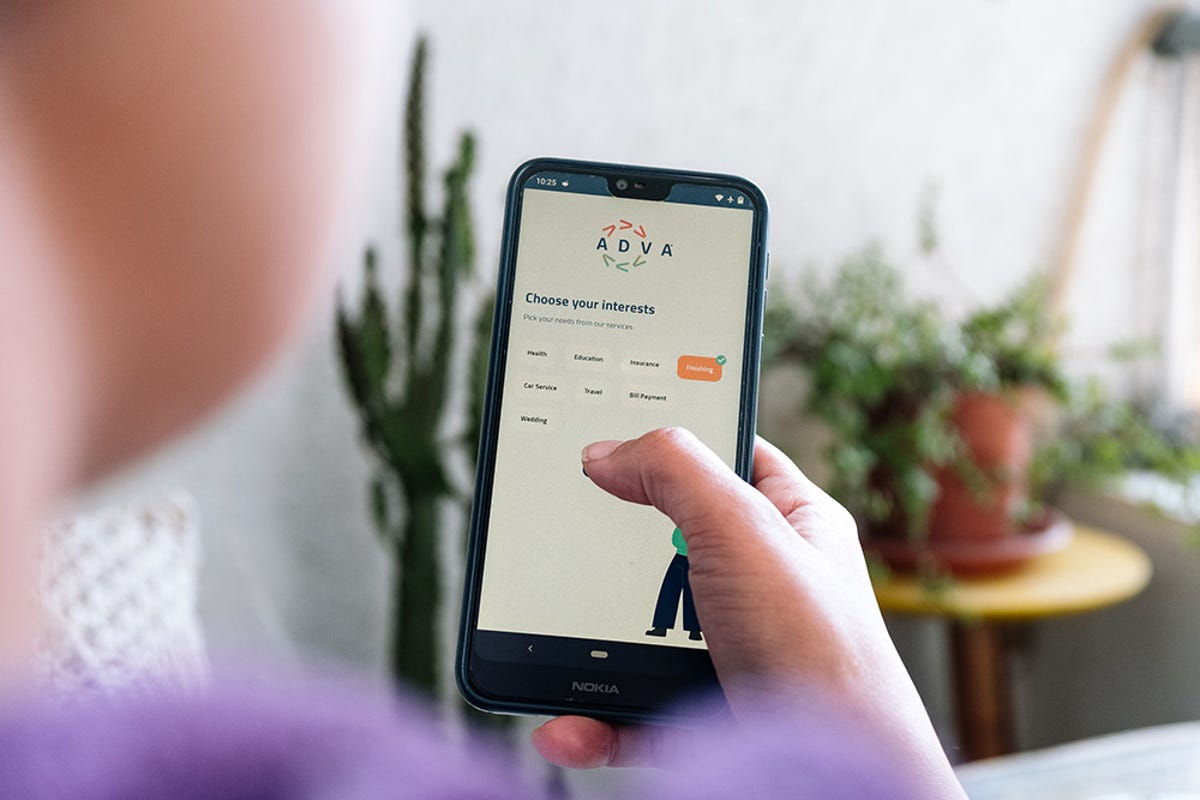

ADVA

ADVA is a marketplace providing financial solutions for essential services like health, education and solar panels at best rates.

Middle East and North Africa

Egypt

Fellow

2024

Updated March 2024

In Egypt, low-income workers have limited access to financing

Nearly 70 percent of Egyptian adults work in informal cash-only jobs that make it difficult to get loans for essential expenses. This forces them to turn to non-bank lenders who charge high interest rates, offer little flexibility in payment terms, and impose harsh repercussions if borrowers default.

“A lot of people have gone to jail as a result of decades of this informal lending to the poor,” says ADVA CEO Rania Gaafar. “Brokers don’t check credit burdens, creditworthiness, or ability to pay back. They loan the money at 30 percent interest, and if people don’t pay, they start harassing them.” These informal lending channels also prevent people from building a credit history that would allow them to borrow with better terms in the future.

Something had to be done to help people who work in the informal sector get financing for essential services. ADVA was the first in the market to offer such a solution. We help unbanked people establish and build credit with loan installments they can afford.

Self-employed and unbanked workers get fast access to loans for essential services

As a senior manager for a large ride-hailing company, Rania saw drivers struggle to get loans, even for critical expenses. For her, the tipping point came when the company’s bank couldn’t make a loan to a driver who needed to pay for his daughter’s surgery. “I felt that something needed to be done for people like him,” she says.

Rania founded the company in June 2020 to help self-employed and unbanked people—most of whom are women–get financing quickly. ADVA’s digital platform connects them to financing institutions offering low-interest rate loans for essential services like medical care, education, and car repair. “People don’t have the headache of worrying about how they’re going to afford a service,” she says. “They can rely on us.”

Rania hopes that by using ADVA, unbanked customers also can learn about responsible financing and cash management.

We want to make essential services like healthcare accessible to everyone, enhancing people’s quality of life.

First-time borrowers benefit from a network of 2,800 service providers

Since launching, ADVA has enabled 18,000 transactions with an average loan amount of US$1,100; 13,000 of those loans have benefited first-time borrowers, the majority women. The company also has built an extensive network of more than 2,800 service providers offering customers a diverse range of services.

“Seventy percent of the loans we’ve provided have been to people who haven’t borrowed from a formal sector before. Financial inclusion is very important to us.” And, Rania says, ADVA’s default rate is very low because borrowers receive services instead of cash. “People who borrow to pay for their kid’s education or health care tend to be very responsible. It’s different from someone who wants to upgrade to the latest model of mobile phone on credit. ”

Rania hopes to bring ADVA to other African countries like Morocco, Tunisia, and Algeria with large populations of unbanked people who today have to rely on informal lending networks. In the meantime, she is inspired by the stories she hears from customers. “The biggest reward I get is when people tell us how their lives have changed as a result of the operation they were finally able to afford or because they could pay their kids’ tuition in installments and keep them in the same school.”

We hope to end informal financing that leads people to bankruptcy and jail. ADVA could mean the beginning of real financial inclusion for unbanked people.